Do all cryptocurrencies use blockchain

A cryptocurrency is a digital or virtual currency that uses cryptography for security and operates on a decentralized blockchain network. It enables peer-to-peer transactions without intermediaries like banks or governments https://fishbreeding.info/. Examples include Bitcoin and Ethereum.

To add a new coin to Blockspot.io, fill out our submission form with all the necessary details, such as name, ticker, logo, type, supply, and other metadata. The form can be accessed at Submitting a coin to our platform is completely free, and we’ll review your submission before adding it to our extensive database of cryptocurrencies.

The abundance of cryptocurrencies and tokens is primarily due to the ease of creating tokens using templates and tools. Forking public repositories of existing cryptocurrencies is also very easy. This accessibility allows developers, businesses, and even non-tech-savvy individuals to create unique digital assets tailored to specific use cases, industries, financial solutions, or simply for fun and experimentation. As a result, we see a diverse and growing ecosystem of digital currencies.

NFTs, or non-fungible tokens, represent ownership of a unique digital file, often used for digital art, collectables, or other virtual assets. While NFTs share similarities with cryptocurrencies, such as being traded on similar marketplaces, they are not considered cryptocurrencies due to their non-fungible nature. You can read more about it in this article we wrote:

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

Are all cryptocurrencies mined

Although a maximum of 21 million bitcoins can be minted, it’s likely that the number of bitcoins circulating remains substantially below that number. Bitcoin holders can lose access to their bitcoins, such as by losing the private keys to their Bitcoin wallets or passing away without sharing their wallet details. A June 2020 study by the crypto forensics firm Chainalysis estimated that up to 20% of the Bitcoin already issued may be permanently lost.

Though they are, by name, opposites, the purpose of mined and non-mined cryptocurrency is the same: validation. Ultimately, each transaction processed over a blockchain network needs to be verified by someone to ensure that the same virtual token wasn’t spent twice. In effect, it describes the process of proofing a transaction to make sure it’s true. A group of transactions is considered to be part of a “block,” and when a block of transactions has been validated, it joins the previously validated blocks to create a chain of true transactions, or a “blockchain.”

Although a maximum of 21 million bitcoins can be minted, it’s likely that the number of bitcoins circulating remains substantially below that number. Bitcoin holders can lose access to their bitcoins, such as by losing the private keys to their Bitcoin wallets or passing away without sharing their wallet details. A June 2020 study by the crypto forensics firm Chainalysis estimated that up to 20% of the Bitcoin already issued may be permanently lost.

Though they are, by name, opposites, the purpose of mined and non-mined cryptocurrency is the same: validation. Ultimately, each transaction processed over a blockchain network needs to be verified by someone to ensure that the same virtual token wasn’t spent twice. In effect, it describes the process of proofing a transaction to make sure it’s true. A group of transactions is considered to be part of a “block,” and when a block of transactions has been validated, it joins the previously validated blocks to create a chain of true transactions, or a “blockchain.”

A few months ago we attempted to tackle this lack of knowledge by examining the basics of cryptocurrencies, blockchain technology, and more recently cryptocurrency mining. Today, we’ll expand on this latter point by taking a closer look at the side-by-side differences of “mined” cryptocurrencies versus non-mined ones. And, as always, we’ll do so in plain English, without all the technical jargon.

The proof-of-work model is also potentially vulnerable to having an individual or group gain control of 51% of its network’s computing power. If a hacker or entity gained this much control, it would be possible to essentially hold the network, and its investors, hostage. For prominently mined cryptocurrencies like bitcoin, Ethereum, Litecoin, and Monero, this isn’t a big concern. However, smaller cryptocurrencies with long block processing times and weak daily volume could be susceptible.

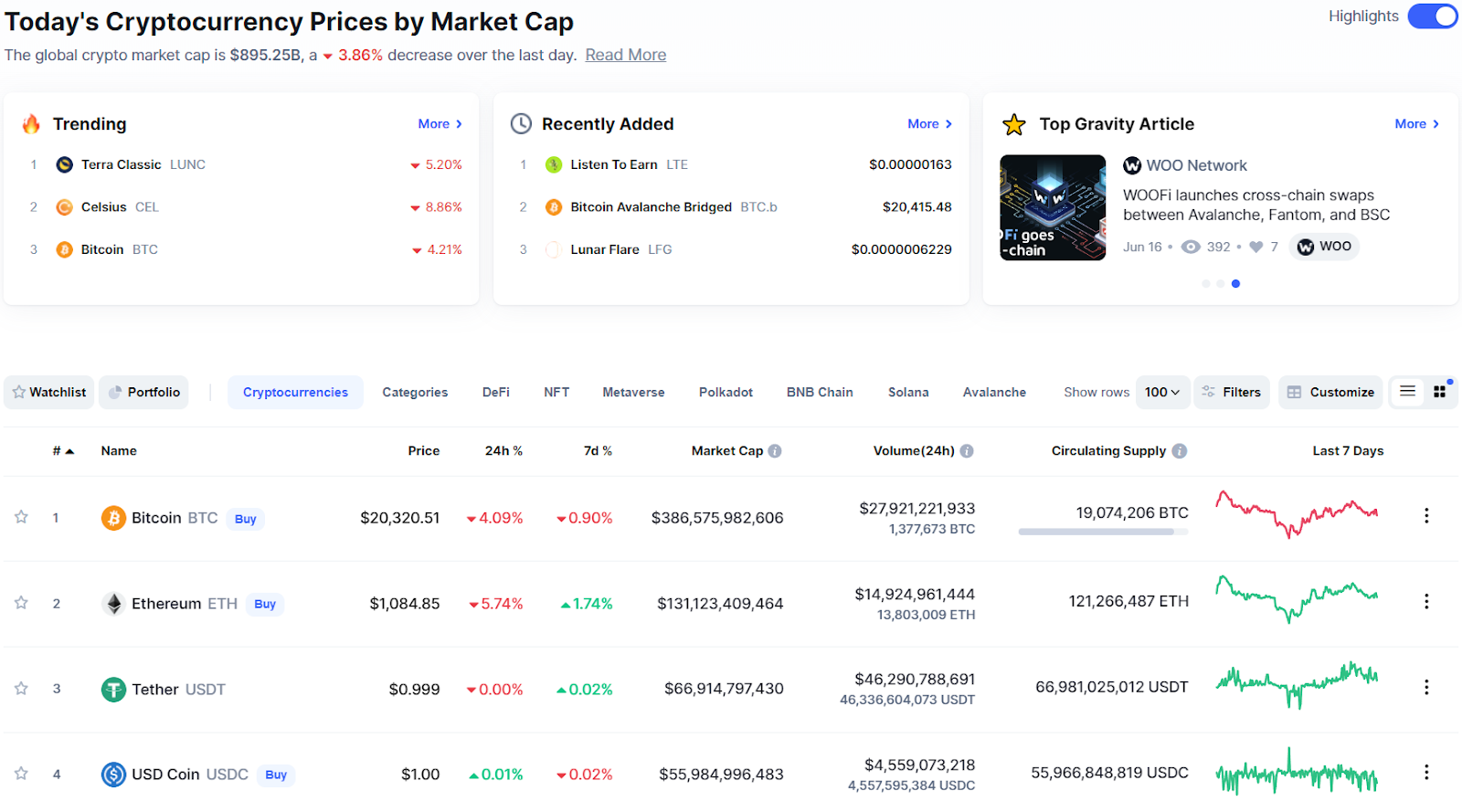

What is the market cap of all cryptocurrencies

Generally, altcoins attempt to improve upon the basic design of Bitcoin by introducing technology that is absent from Bitcoin. This includes privacy technologies, different distributed ledger architectures and consensus mechanisms.

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

IEO stands for Initial Exchange Offering. IEOs share a lot of similarities with ICOs. They are both largely unregulated token sales, with the main difference being that ICOs are conducted by the projects that are selling the tokens, while IEOs are conducted through cryptocurrency exchanges. Cryptocurrency exchanges have an incentive to screen projects before they conduct a token sale for them, so the quality of IEOs tends to be better on average than the quality of ICOs.

Generally, altcoins attempt to improve upon the basic design of Bitcoin by introducing technology that is absent from Bitcoin. This includes privacy technologies, different distributed ledger architectures and consensus mechanisms.

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

IEO stands for Initial Exchange Offering. IEOs share a lot of similarities with ICOs. They are both largely unregulated token sales, with the main difference being that ICOs are conducted by the projects that are selling the tokens, while IEOs are conducted through cryptocurrency exchanges. Cryptocurrency exchanges have an incentive to screen projects before they conduct a token sale for them, so the quality of IEOs tends to be better on average than the quality of ICOs.

Leave a Reply