Cryptocurrency market

We rank cryptocurrencies based on the market cap by default. However, we do offer filters according to other metrics such as trading volume or price. Besides market cap, we also implemented certain criteria to decide which ‘tier’ a coin would be placed at https://cheaphotflights.com/. Learn more about how we rank coins.

A stablecoin is a crypto asset that maintains a stable value regardless of market conditions. This is most commonly achieved by pegging the stablecoin to a specific fiat currency such as the US dollar. Stablecoins are useful because they can still be transacted on blockchain networks while avoiding the price volatility of “normal” cryptocurrencies such as Bitcoin and Ethereum. Outside of stablecoins, cryptocurrency prices can change rapidly, and it’s not uncommon to see the crypto market gain or lose more than 10% in a single day.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

Hawk tuah girl cryptocurrency

This has led some, including YouTube cryptocurrency investigator Coffeezilla, to accuse Ms Welch of scamming investors with a “pump and dump” – where the people behind a coin hype up its price before launch, then sell it for profit.

Influencer Haliey Welch, who shot to internet stardom this year thanks to a particularly viral interview clip, is pushing back on accusations that “HAWK,” the cryptocurrency she helped launch this week, is a scam after its price plummeted. Welch said on X that she and the people behind the coin have not sold any of their holdings.

“It’s not really that it’s hard to trust people,” Welch told Vanity Fair. “It really makes you sit there and question them more than you probably would have before. Just because you don’t want to get in another pickle.”

The lawsuit did not directly name Welch, but instead claimed her social media following had been used to market the coin by defendants including Tuah The Moon Foundation, which oversaw the memecoin’s finances; OverHere Ltd, which created the coin; Clinton So, executive at OverHere; and the coin’s promoter Alex Larson Schultz.

YouTuber and crypto journalist Stephen Findeisen, who has amassed millions of followers on social media under the name Coffeezilla, confronted Welch in a live X Space audio conversation Wednesday, titled “The Hawk Truth.” In clips of the conversation, which circulated on X, Welch’s team denied Findeisen’s accusations of “rug pulling,” a term used in the crypto world for projects in which a coin’s creators seek to build hype and drive up a coin’s price only for them to sell their holdings at a profit, which then leaves other investors with devalued tokens after prices drop dramatically.

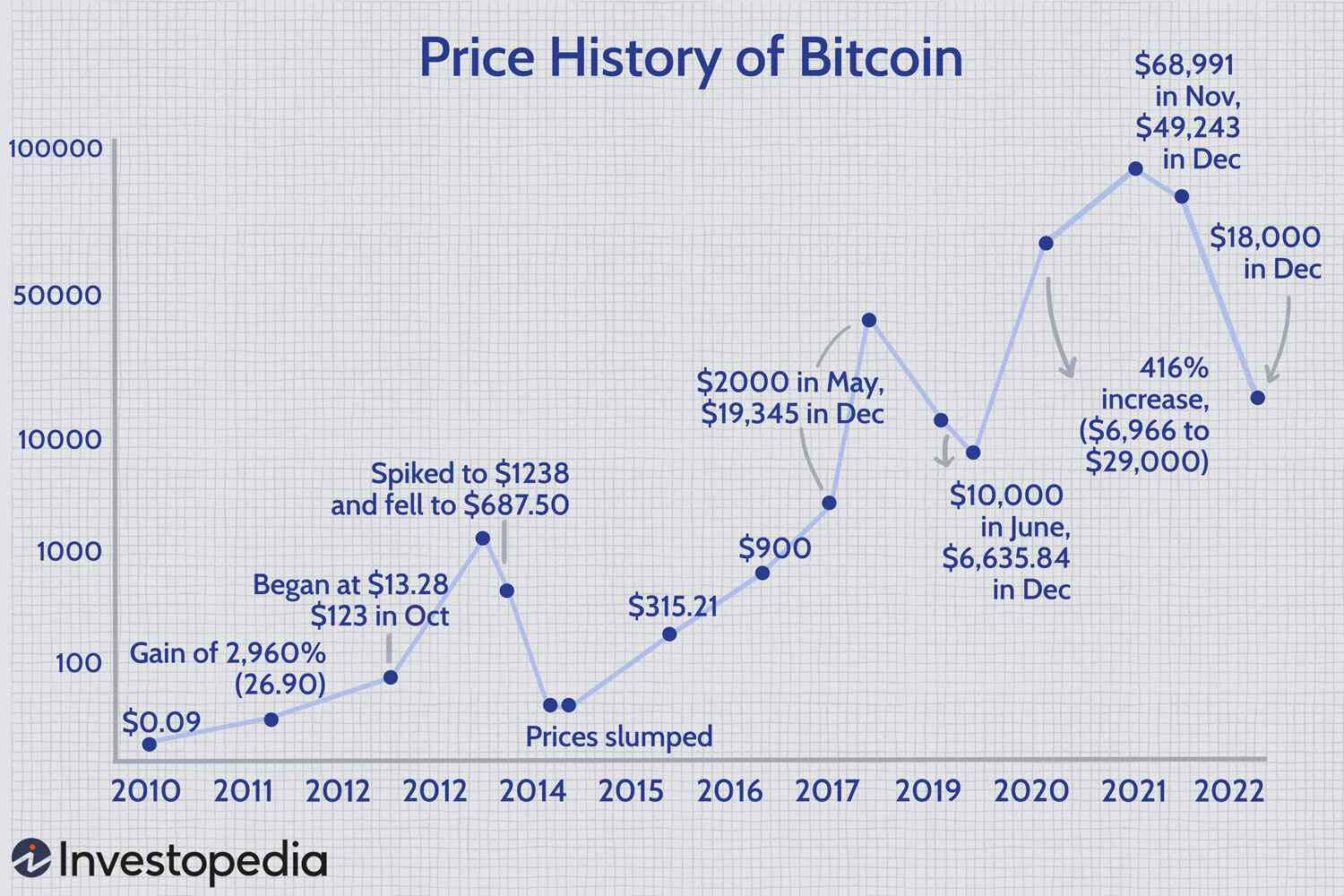

Cryptocurrency bitcoin price

TThe data at CoinMarketCap updates every few seconds, which means that it is possible to check in on the value of your investments and assets at any time and from anywhere in the world. We look forward to seeing you regularly!

Some examples of prominent cryptocurrencies that have undergone hard forks are the following: Bitcoin’s hard fork that resulted in Bitcoin Cash, Ethereum’s hard fork that resulted in Ethereum Classic.

A few years ago, the idea that a publicly traded company might hold Bitcoin on its balance sheets seemed highly laughable. The flagship cryptocurrency was considered to be too volatile to be adopted by any serious business. Many top investors, including Warren Buffett, labeled the asset a “bubble waiting to pop.”

The top crypto is considered a store of value, like gold, for many — rather than a currency. This idea of the first cryptocurrency as a store of value, instead of a payment method, means that many people buy the crypto and hold onto it long-term (or HODL) rather than spending it on items like you would typically spend a dollar — treating it as digital gold.

TThe data at CoinMarketCap updates every few seconds, which means that it is possible to check in on the value of your investments and assets at any time and from anywhere in the world. We look forward to seeing you regularly!

Some examples of prominent cryptocurrencies that have undergone hard forks are the following: Bitcoin’s hard fork that resulted in Bitcoin Cash, Ethereum’s hard fork that resulted in Ethereum Classic.

Cryptocurrency market

Let’s quickly calculate the market cap of Bitcoin as an example. The Bitcoin price is currently $ 104,584 and there are 19.86 million BTC coins in circulation. If we use the formula from above, we multiply the two numbers and arrive at a market cap of 2,077.47 billion.

A cryptocurrency is a digital currency that keeps records about balances and transactions on a distributed ledger, which is most commonly in the form of a blockchain. Cryptocurrencies enable peer-to-peer transactions between participants across the globe on a 24/7 basis.

The Bitcoin market cap is currently 2,077.47 billion. We arrive at this figure by multiplying the price of 1 BTC and the circulating supply of Bitcoin. The Bitcoin price is currently $ 104,584 and its circulating supply is 19.86 million. If we multiply these two numbers, we arrive at a market cap of 2,077.47 billion.

We calculate a cryptocurrency’s market cap by taking the cryptocurrency’s price per unit and multiplying it with the cryptocurrency’s circulating supply. The formula is simple: Market Cap = Price * Circulating Supply. Circulating supply refers to the amount of units of a cryptocurrency that currently exist and can be transacted with.

The total crypto market volume over the last 24 hours is $148.54B, which makes a 12.36% decrease. The total volume in DeFi is currently $25.79B, 17.36% of the total crypto market 24-hour volume. The volume of all stable coins is now $138.76B, which is 93.42% of the total crypto market 24-hour volume.

Leave a Reply